You’re not logged in!

You’ll need to log in to get access to all of the premium content on this site.

You’ll need to log in to get access to all of the premium content on this site.

by mark little Filed Under: Client Meetings

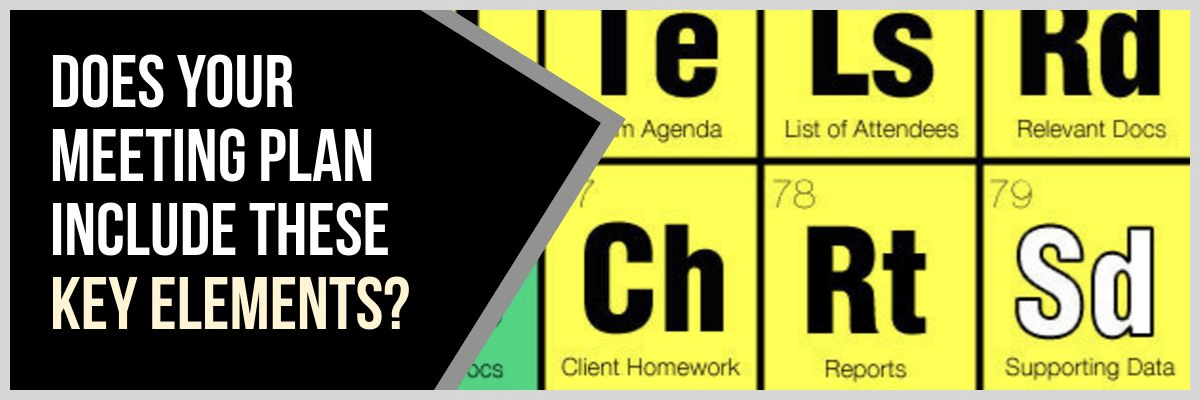

Do you know a recipe for disaster for you and your clients? It’s calling your team members to an unannounced client meeting and just winging it. In reality, can you expect everyone to be available and prepared without prior knowledge? Of course not! For it to be an exceptional meeting, you need to have every item pinned down beforehand.

Leave a Reply